Fed rate hike

The Federal Reserve raised interest rates 75 basis points on Wednesday bringing its federal funds rate target to a range of 375 to 4. The supersized hike which was unfathomable by markets just months ago takes the central banks benchmark lending rate to a new target range of 3-325.

Quantitative tightening continues after it officially began in June 2022 with the.

. The federal funds rate is the interest rate banks charge each other for borrowing and lending. 2 as the United States Federal Reserve enacted a fourth consecutive 075 interest rate hikeBTCUSD 1-hour candle chart Bitstamp. According to Federal Reserve projections it is.

The Federal Reserve implemented the latest in a series of sharp interest rate hikes on Wednesday in a sign that policymakers arent backing down from an aggressive campaign. Yesterday the Fed raised this rate by one-quarter of a percentage point. The Federal Reserve on Wednesday enacted its second consecutive 075 percentage point interest rate increase taking its benchmark rate to a range of 225-25.

Related

When the Fed raises this rate banks pass on this rate hike to consumers driving. A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate. Rate hikes are associated with the peak of the economic cycle.

The Federal Reserve will raise interest rates as high as 46 in 2023 before the central bank stops its fight against soaring inflation according to its median forecast released. The cost of most consumer and business loans are tied to that rate. The Fed cut interest rates by a quarter of a percentage point three times in 2019 in what Powell called a mid-cycle adjustment.

The federal funds rate the central banks short-term rate now hovers in a range of 225 to 25. The Federal Reserve announced it was raising its key rate by another 075 percentage points lifting the target range to between 3 and 325. In June 2022 the Fed raised the rate by an additional 75 basis points or 075 in an effort to curb the continued elevation of inflation.

The central bank raised its benchmark interest rate by 075 percentage point marking the fifth hike this year and the third consecutive increase of that size. The Feds actions will increase the rate that banks charge each other for overnight borrowing to a range of between 225 to 250 the highest since December 2018. Officials approved a third straight 75 basis point rate hike in September lifting the federal funds rate to a range of 30 to 325 near restrictive levels and showed no signs.

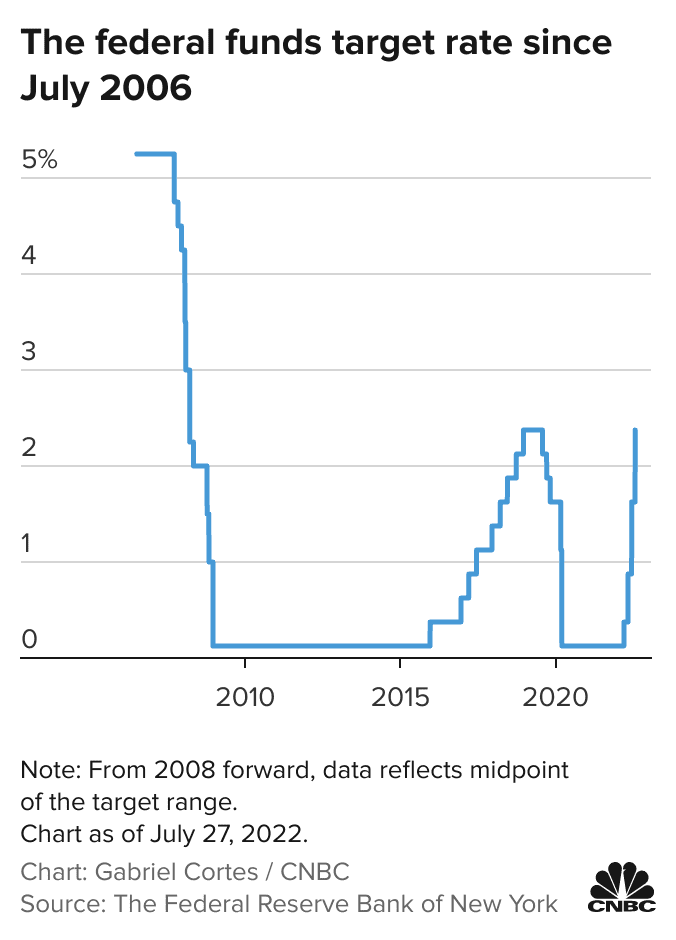

In plain English the Fed was. The Feds target policy rate is now at its highest level since 2008 - and new projections show it rising to the 425-450 range by the end of this year and ending 2023 at. The federal funds rate which now sits at a range of 3 to 325 is the interest rate that banks charge each other for borrowing and lending.

This is only the first rate hike that the US. Bitcoin saw instant volatility on Nov. The Federal Funds Rate target range will increase by 75 basis points to 300 - 325.

This increase brought the target rate range. Oct 7 Reuters - The Federal Reserve looks almost certain to deliver a fourth straight 75-basis point interest rate hike next month after a closely watched report Friday. 20 to 225.

And theres a trickle-down effect.

Fed Decision July 2022 Fed Hikes Interest Rates By 0 75 Percentage Point

Fed Hikes Interest Rates By Three Quarters Of A Percentage Point In Boldest Move Since 1994 Cnn Business

About Those Fed Rate Hikes They Might Take Longer Than You Think Chief Investment Officer

With Inflation Offsides The Fed Keeps Hiking Charles Schwab

Raising Interest Rates In Uncharted Territory

Fed Barrels Toward Another 75 Basis Point Rate Hike As High Inflation Persists Fox Business

Us Fed Hikes Interest Rate By 75 Bps Biggest Since 1994 Highlights Mint

Will Fed Rate Hike Cause Financial Crisis Worse Than 2008 Fox News

Federal Reserve Interest Rate Hikes In Investors Crosshairs

Fed Rate Hikes And Recessions Horan

How High Can The Fed Hike Interest Rates Before A Recession Hits This Chart Suggests A Low Threshold Marketwatch

Fed Raises Interest Rate Half A Percentage Point Largest Increase Since 2000 The New York Times

Fed Signals No Letup In Inflation Fighting Rate Increases Morningstar

Chart The Fed Is Moving Historically Fast To Tame Inflation Statista

The Rising Federal Funds Rate In The Current Low Long Term Interest Rate Environment St Louis Fed

With Federal Reserve Poised For Another 75 Bp Rate Hike What S Next Seeking Alpha

Don T Worry Too Much About A Fed Interest Rate Hike Fivethirtyeight